Account Outsourcing

In the realm of efficient business management, having a well-integrated Accounts and Bookkeeping Department is paramount for success. This department is responsible for accurately reporting, classifying, analyzing, and interpreting financial data, which is crucial for informed decision-making and business growth.

For small and medium enterprises, managing an in-house Accounting and Bookkeeping Department can be challenging, both in terms of time and costs. Often, internal resources may lack professional skills and stay unaware of the latest compliances and regulations. In such scenarios, Accounts Outsourcing emerges as the optimal solution.

Recognizing the significance of accounting and bookkeeping, we offer comprehensive services led by a team of experts and professionals. Our dedicated professionals ensure accurate recording of transaction data, leading to the preparation of profit and loss statements and balance sheets.

Beyond Accounts Outsourcing, we extend our expertise to manage Legal and Tax compliances. This includes filing Income Tax returns, preparing documents for assessments with the Income Tax Department, deducting TDS on vendor payments, timely remittance to the government, filing TDS returns, and issuing TDS certificates and Form 16 to employees.

In essence, our services encompass all the essentials needed to run your Accounts and Taxation compliance effectively.

Effective accounting is indispensable for the sustained growth and enduring success of your business; it serves as a foundation that aids in navigating financial complexities and ensuring long-term viability. premises or our own.

Sound accounting is vital for business growth, ensuring longevity and informed decision-making.

Make Informed Decisions

Comply with Regulations

Secure Financing

Monitor Cash Flow

Evaluate Performance

Facilitate Tax Planning

Build Credibility

Plan for the Future

Our Services Includes:

Real-Time Accounts Management:

Continuous updating of accounts.

Continuous updating of accounts.Tax and Regulatory Compliance:

Filing of Income Tax, TDS, GST, PT, EPF & ESIC Returns.

Filing of Income Tax, TDS, GST, PT, EPF & ESIC Returns. Auditing under Income Tax Act, GST, and Companies Act.

Auditing under Income Tax Act, GST, and Companies Act.Financial Reporting:

Finalization of Books of Accounts for Statutory Audit.

Finalization of Books of Accounts for Statutory Audit. Preparation of Trial Balance, Profit and Loss Account & Balance Sheet.

Preparation of Trial Balance, Profit and Loss Account & Balance Sheet.MIS Reports:

List Preparation of MIS Reports on Weekly, Monthly, and Quarterly basis.

List Preparation of MIS Reports on Weekly, Monthly, and Quarterly basis.Cash Flow Management:

Preparation of Monthly reports and Cash Flow Statements.

Preparation of Monthly reports and Cash Flow Statements.Payroll and Compliance:

Payroll management and Labour Law Compliances.

Payroll management and Labour Law Compliances.

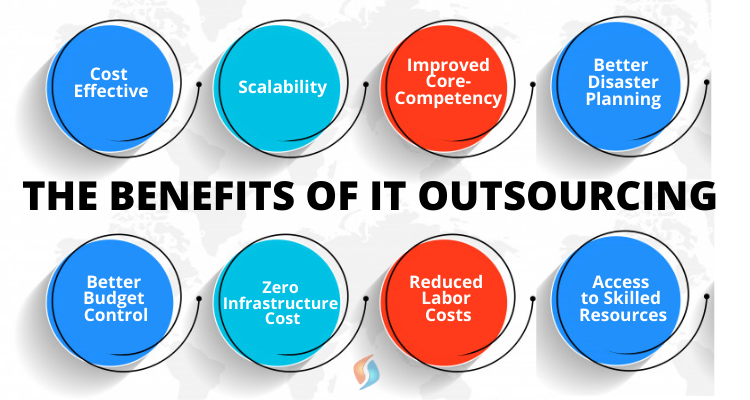

Why you should Outsource?

Why you should outsource to jain TaxTech?

Data-Driven Financial Advice

![]() Acquire expert financial advice grounded in facts and data.

Acquire expert financial advice grounded in facts and data.

Reliable and Timely Accounts Processing

![]() Be assured of accurate accounts processing, on time, every time.

Be assured of accurate accounts processing, on time, every time.

Cost-Effective Solution

![]() Pay for services received; no need to spend on employee training.

Pay for services received; no need to spend on employee training.

Technology and Software Savings

![]() Eliminate investments in technology and software.

Eliminate investments in technology and software.

Customized Decision Support

![]()

Receive customized reports for faster decision-making across the organization.